Report Overview

The global industrial gases market size was valued at USD 99.99 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.42% from 2023 to 2030. The growth is primarily driven by the growing manufacturing industry in developing economies of the Asia Pacific region. Rapid industrialization and application of industrial gases in various industries, such as manufacturing, mining, metals, food & beverage, and healthcare, are further expected to influence the market growth in the coming years. However, environmental regulations, safety, and high gas conversion costs may hinder the industry growth during the forecast period.

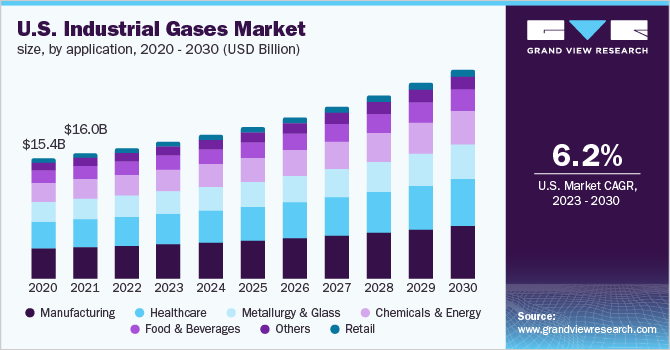

The U.S. accounted for a majority share in the North America regional market and is expected to retain its leading position throughout the forecast period. The U.S. emerged as one of the major countries utilizing industrial gases, as the country has the presence of a large number of major industrial gas suppliers, such as Linde, Air Liquide, Messer, and Air Products & Chemicals. The growing healthcare industry in the U.S., coupled with growing R&D in the healthcare sector owing to the recent outbreak of the COVID-19 pandemic, is expected to propel the demand for industrial gases in the U.S.The dependence of the electronics end-use sector on industrial gases has provided an alternate source of opportunity for the market, given the broad range of applications from flat-panel displays and semiconductors to LED lights and solar cells. Unlike the petrochemical and metallurgy industry, the electronics end-use industry embraces suppliers to greater standards with regard to project experience, coverage, and technical specifications. Asia Pacific accounted for a significant revenue share in 2022 and is projected to continue to dominate the global market during the forecast period. The economic growth in countries, such as China, India, and South Korea, has shown strong growth and the trend is expected to continue during the forecast period. The presence of major electronics companies in the U.S. is also one of the major reasons driving the demand for industrial gases. In the U.S., the usage of electronics is increasing day by day, with an ever-growing number of electronic devices and gadgets being manufactured for the convenience of consumers. The growing healthcare and electronic industries across the region are likely to promote market growth. Expansion of the industrial sector is anticipated to further fuel the regional market.

Gather more insights about the market drivers, restrains and growth of the Global Industrial Gases Market

Product Insights

On the basis of products, the global industry has been further categorized into oxygen, nitrogen, hydrogen, carbon dioxide, acetylene, and argon. The oxygen product segment dominated the industry in 2022 and accounted for the highest share of 28.43% of the overall revenue. Oxygen is utilized for fabrication, steel melting, medical applications, copper smelting, etc. Oxygen is known to improve the thermal efficiency of fuel. Thus, oxygen can be used as a methodology for obtaining better energy from fuel.

Distribution Insights

The cylinder segment led the industry in 2022 and accounted for the largest revenue share of 36.55%. It is the most preferred form of distribution by consumers. This type of distribution is practiced by independent gas distributors by purchasing gas from producers and compressing them in their packaging facilities. Many gases are also supplied at room temperature in the liquid state. The gases are stored at low pressure in thin-walled steel or composite aluminum cylinders. The bulk (Liquid Gas Transport) distribution segment accounted for the second-largest share in 2022. This involves the gas in a liquefied or natural state being transported by either road (dedicated trailers) or via pipelines (over long distances).

Application Insights

The manufacturing industry application segment accounted for the largest share of 27.05% of the overall revenue in 2022 and is projected to grow at the second-highest CAGR during the forecast period. The demand for industrial gases in the manufacturing industry is projected to witness rapid growth owing to various applications. Carbon dioxide is frequently used in the rubber industry in the form of dry ice for the non-abrasive cleaning of rubber molds. It is commonly used by manufacturers of molded rubber products to reduce production downtime and maintenance & labor costs. The use of carbon dioxide for the cleaning of essential tools and molds in the rubber industry offers various advantages over conventional cleaning methods.

Regional Insights

On the basis of geographies, the global industry has been further categorized into Asia Pacific, North America, Europe, Latin America, and Middle East & Africa. Asia Pacific dominated the industry at 36.64% in 2022, in terms of revenue share, and is expected to be the fastest-growing region with a CAGR of 9.8% over the forecast period. The growth and expansion of end-use industries in key markets like India, China, South Korea, and Japan are expected to drive the demand for industrial gases in the region.

Key Companies & Market Share Insights

The global industry is highly competitive due to the strong presence of many regional as well as multinational companies. Key industry participants are involved in research and development and constant innovation, which have become among the most important factors for them to perform in the competitive industry.

Browse through Grand View Research's Petrochemicals Industry Research Reports.

- Diesel Exhaust Fluid Market Size, Share & Trends Analysis Report By Vehicle (LCV, HCV), By Component (Catalyst, Sensor), By Application (Construction Equipment, Agricultural Tractor), By Region, And Segment Forecasts, 2024 - 2030

- Cold Flow Improvers Market Size, Share & Trends Analysis Report By Product (Ethylene Vinyl Acetate, Polyalkyl Methacrylate), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

Some of the prominent players operating in the global industrial gases market are:

- Air Liquide

- Air Products Inc.

- INOX-Air Products Inc.

- Iwatani Corp.

- Linde plc

- Messer

- SOL Group

- Strandmøllen A / S

- Taiyo Nippon Sanso Corp.

Industrial Gases Market Segmentation

Grand View Research has segmented the global industrial gases market based on product, application, distribution, and region:

Industrial Gases Product Outlook (Volume, Million SCF; Revenue, USD Million, 2018 - 2030)

- Nitrogen

- Hydrogen

- Carbon Dioxide

- Oxygen

- Argon

- Acetylene

Industrial Gases Application Outlook (Volume, Million SCF; Revenue, USD Million, 2018 - 2030)

- Healthcare

- Manufacturing

- Metallurgy & Glass

- Food & Beverages

- Retail

- Chemicals & Energy

- Others

Industrial Gases Distribution Outlook (Volume, Million SCF; Revenue, USD Million, 2018 - 2030)

- On-site

- Bulk (Liquid Gas Transport)

- Cylinder (Merchant)

Industrial Gases Regional Outlook (Volume, Million SCF; Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- U.K.

- Germany

- France

- Italy

- Spain

- The Netherlands

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Malaysia

- Thailand

- Singapore

- Latin America

- Brazil

- Middle East & Africa

- Saudi Arabia

- UAE

Order a free sample PDF of the Industrial Gases Market Intelligence Study, published by Grand View Research.

About Grand View Research

Grand View Research is a full-time market research and consulting company registered in San Francisco, California. The company fully offers market reports, both customized and syndicates, based on intense data analysis. It also offers consulting services to business communities and academic institutions and helps them understand the global and business scenario to a significant extent. The company operates across multitude of domains such as Chemicals, Materials, Food and Beverages, Consumer Goods, Healthcare, and Information Technology to offer consulting services.

Explore Horizon, the world's most expansive market research database