IMARC Group’s report titled “BFSI Crisis Management Market Report by Component (Software, Services), Deployment Type (On-premises, Cloud-based), Enterprises Size (Large Enterprises, Small and Medium-sized Enterprises), Application (Disaster Recovery and Business Continuity, Risk and Compliance Management, Crisis Communication, Incident Management and Response, and Others), End User (Banks, Insurance Companies, and Others), and Region 2025-2033” , The global BFSI crisis management market size reached USD 18.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 64.8 Billion by 2033, exhibiting a growth rate (CAGR) of 15.1% during 2025-2033.

Grab a sample PDF of this report: https://www.imarcgroup.com/bfsi-crisis-management-market/requestsample

Factors Affecting the Growth of the BFSI Crisis Management Industry:

- Enhanced Regulatory Compliance and Risk Management:

The Banking, Financial Services, and Insurance (BFSI) sector is facing more pressure to follow stricter rules and improve risk management. This has become even more important after recent financial crises and economic uncertainty. Governments are setting tougher regulations to make sure financial institutions are prepared for crises. To meet these demands, companies are using tools like artificial intelligence (AI) and machine learning (ML) to spot risks, understand their impact, and reduce them. Real-time monitoring and reporting are now key for staying compliant with these rules. By focusing on these improvements, financial institutions aim to build strength, keep customer trust, and avoid major problems during uncertain times.

- Digital Transformation and Technology Integration:

Digital transformation is also changing how financial institutions handle crises. As technologies like fintech and digital banking grow, new risks are emerging, and organizations need to rethink their crisis management strategies. Many are using tools like cloud computing, big data, and blockchain to improve how they share data, manage processes, and communicate during emergencies. Digital platforms are especially important for keeping customers informed and maintaining trust during crises. As the industry adopts more digital solutions, the need for crisis management technology will grow, helping organizations adapt quickly to changes.

- Focus on Cybersecurity and Data Protection:

Cybersecurity and data protection are becoming more important as the BFSI sector goes digital. Cyberattacks are more common and complex, creating risks for financial institutions. To address this, companies are investing in systems to detect threats early, develop response plans, and train staff on cybersecurity. Regulations like the General Data Protection Regulation (GDPR) and other local laws require stricter protection of sensitive data. Including cybersecurity in crisis management plans helps organizations prepare for cyber threats and stay compliant with these rules.

We explore the factors propelling the BFSI crisis management market growth, including technological advancements, consumer behaviors, and regulatory changes.

Leading Companies Operating in the Global BFSI Crisis Management Industry:

- 4C Group AB

- Beekeeper AG

- Everbridge Inc.

- International Business Machines Corporation

- Logicgate Inc.

- Metricstream Inc.

- NCC Group

- Noggin Pty Ltd

- Rockdove Solutions Inc.

- Sas Institute Inc.

- Software Aktiengesellschaft

- Veoci Inc.

BFSI Crisis Management Market Report Segmentation:

Breakup by Component:

- Software

- Services

Breakup by Deployment Type:

- On-premises

- Cloud-based

Breakup by Enterprises Size:

- Large Enterprises

- Small and Medium-sized Enterprises

Breakup by Application:

- Disaster Recovery and Business Continuity

- Risk and Compliance Management

- Crisis Communication

- Incident Management and Response

- Others

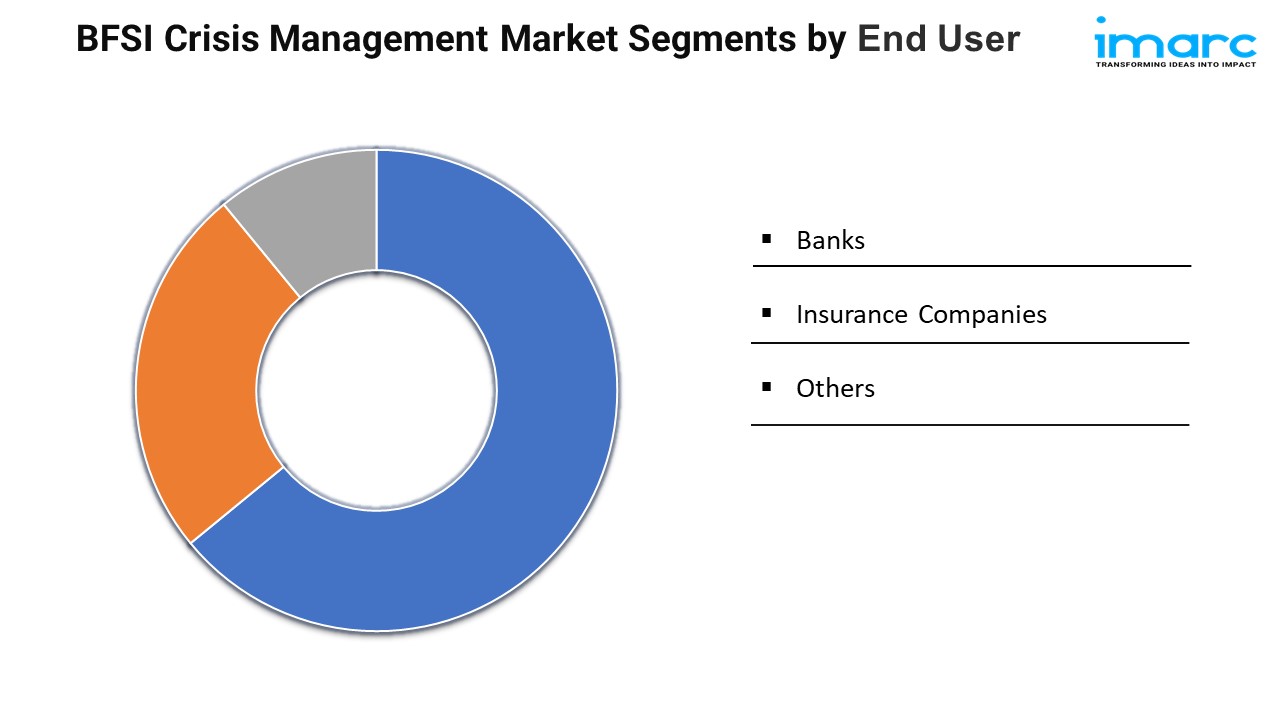

Breakup by End User:

- Banks

- Insurance Companies

- Others

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

BFSI Crisis Management Market Trends:

Looking ahead to 2024, key trends in crisis management for BFSI institutions include the growing use of AI and analytics to predict and respond to crises. There will be more focus on meeting strict regulatory rules with tools that monitor and report risks in real time. Cybersecurity will remain a top priority, with more advanced technologies and stronger data protection. Also, maintaining customer trust during crises will lead to better communication strategies. These trends show the increasing need for new tools and strategies to keep the BFSI sector strong and ready to handle challenges.

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1–631–791–1145